How to use a Funeral Expense Trust to Qualify for Medicaid

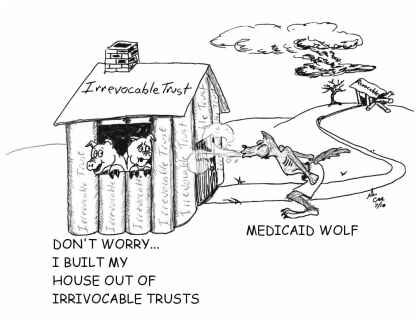

An Irrevocable Funeral Expense Trust [IFET] is a key method of securing Medicaid financial qualification because it is not considered a countable resource, therefore, you can use an IFET to turn excess resources into non-countable exempt assets. When in "crisis" planning, the funeral trust is generally purchased after the "snapshot" date of the resource assessment but before the effective date for which the Medicaid benefits are requested. When pre-planning, it can be purchased at any time. You're permitted to purchase 1 [one] for each spouse.

What is an Irrevocable Funeral Expense Trust [IFET]

The IFET is a blend between a guaranteed issue life insurance policy and an irrevocable trust. The trust is issued and controlled by an insurance company and there are no trust agreements to draft or fees of any kind.

One simple form and you're done

Owners of an Irrevocable Funeral Expense Trust benefit from all of the following:

- Immediately shield assets from Medicaid and nursing homes

- Peace of mind knowing funds are guaranteed to be there when needed most

- Benefits are distributed immediately and tax free

- Excess funds are distributed to the individuals estate

- Funds can be used to pay for travel expenses, food & lodging for family members to attend a funeral

- Assets cannot be confiscated by any nursing home, creditors or lawsuits

- Funds can allow a portion to be used as a gift for a church or synagogue where the funeral is held

- Asset Protection

- Exempt from Medicaid "spend down" requirements

- Funds are insulated against inflation with an increasing death benefit

- No lengthy delays caused by probate court proceedings

- Free from estate taxes

How much money may be set aside in an Irrevocable Funeral Expense Trust?

In order for the funeral trust to not be overly scrutinized or potentially cause an issue in regards to the amount, the rules state that the amount must be of "fair consideration" which means that it should not exceed the average local cost of a funeral with each state having there own maximum limit as stated below;

- Pennsylvania....Each of Pennsylvania's' 67 counties list their own max. limits. Such as in Allegheny County the max. is $15,000 Bucks County - $10,200, Dauphin County - $9,000 and so on, with their "fair consideration" test being met providing the trust does not exceed the average local costs or limits by more than 25%. See the county burial limits chart by clicking HERE

- New Jersey......$15,000

- Maryland..........$15,000

- Delaware..........$10,000

Irrevocable Funeral Expense Trust details;

- Medicaid [DRA] compliant

- Face Amount......up to $15,000 maximum

- Guaranteed issue to age 99

- No medical exams or questions

- No Ongoing Fees

- Funded with a guarantee issue Life Insurance Policy with an increasing death benefit

- Portable - can be used with any funeral home.

- Funds are paid immediately [usually within 2 days]

- Excess funds are paid to the individuals estate

How is an IFET better than a prepaid funeral at a funeral home?

1. Not locked into a particular funeral home with an IFET:

Pre-paying at a funeral home will limit you to that funeral home only, if you change your mind, in most circumstances you can't get a refund. Many funeral homes place the funds in a co-mingled account set up by the State Funeral Directors Association which can lead to mishandling or mismanaged funds causing consumers to lose money. Or, if something horrible happens and the funeral home is no longer in business you may lose your money. [read an article from Elder Law Answers- Pre-paid Funeral Plans - Buyer Beware HERE]

An IFET is portable and can be used at any funeral home and the funds are guaranteed by the insurance company.

2. No Pre-planning with an IFET;

A funeral home will ask you to sit and pre-plan the funeral and decide which items you will be using, which services, any extras they can sell you etc. That way they can determine an exact amount for you to pre-pay. This will take time and a lot of thought [if your doing this for a loved one, you will have to decide all of the things they may have wanted for their funeral], this may delay the Medicaid application which will cause nursing home bills to accumulate.

With an IFET, there's no need to pre-plan, it's simple, you can purchase any amount, up to the maximum permitted by your state, any excess funds that exist after the funeral home [of your choice] is paid, will be paid to the individuals estate. This may help to qualify for Medicaid benefits quicker and you may have funds left over, unlike a funeral home where you must use all funds for the funeral.

3. Rising costs:

Not all costs are guaranteed at a funeral home, rising costs of some items may not be covered and the family will need to pay additional costs and fees over the amount that was pre-paid.

With an IFET, there is an increasing death benefit to cover inflation and rising costs of funeral items, that way the family won't have to pay additionally.

4. Items not covered by a pre-paid funeral:

At a funeral home there are items that are not covered by a pre-paid funeral such as travel expenses for family members, monetary gifts to your church or synagogue where the service is held, clergy fees, police motorcycle escorts, obituaries, etc.

With an IFET, the funds can be used for these costs and all funeral related items and any excess funds over and above the direct funeral costs will be returned to the estate. click HERE to see a list of services